An easy trick to trade stocks.

Last Friday's trading session was nonetheless a head-scratching session. In such a situation, all a trader ask is an easy way to understand which way to go, whether to sell or to buy. That is when Bhoomi jumps in as your savior.

The rules are simple and effective:

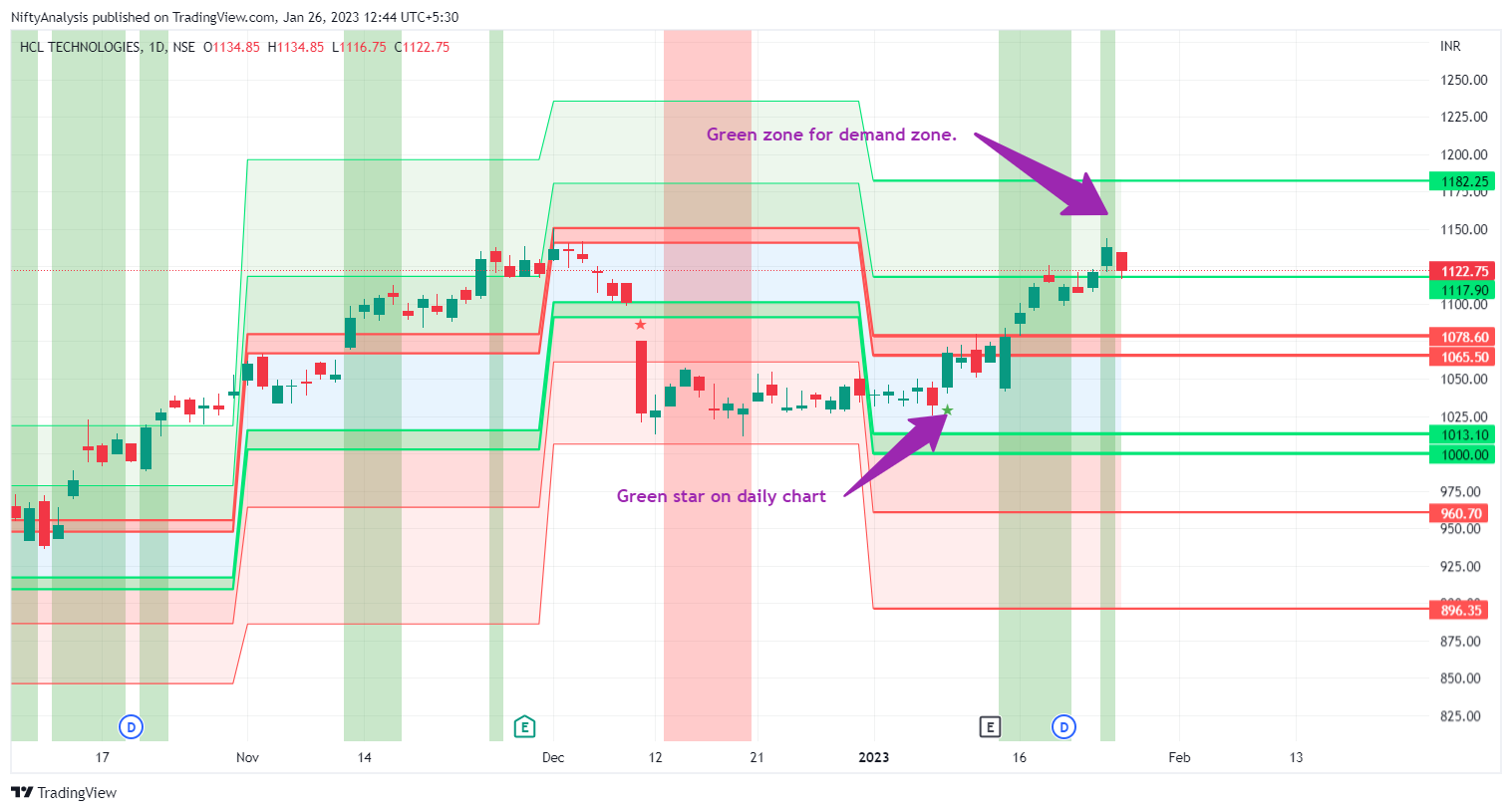

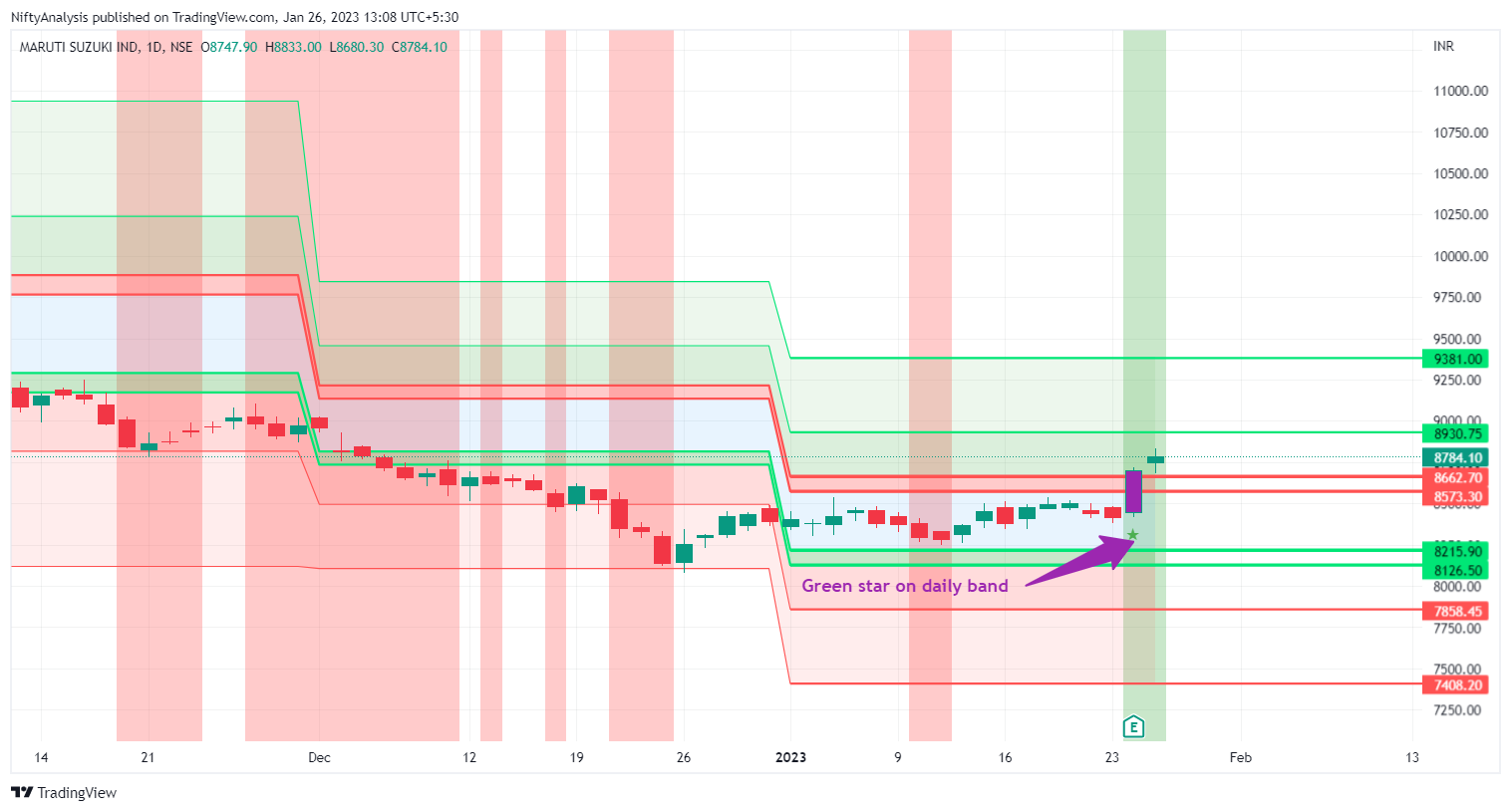

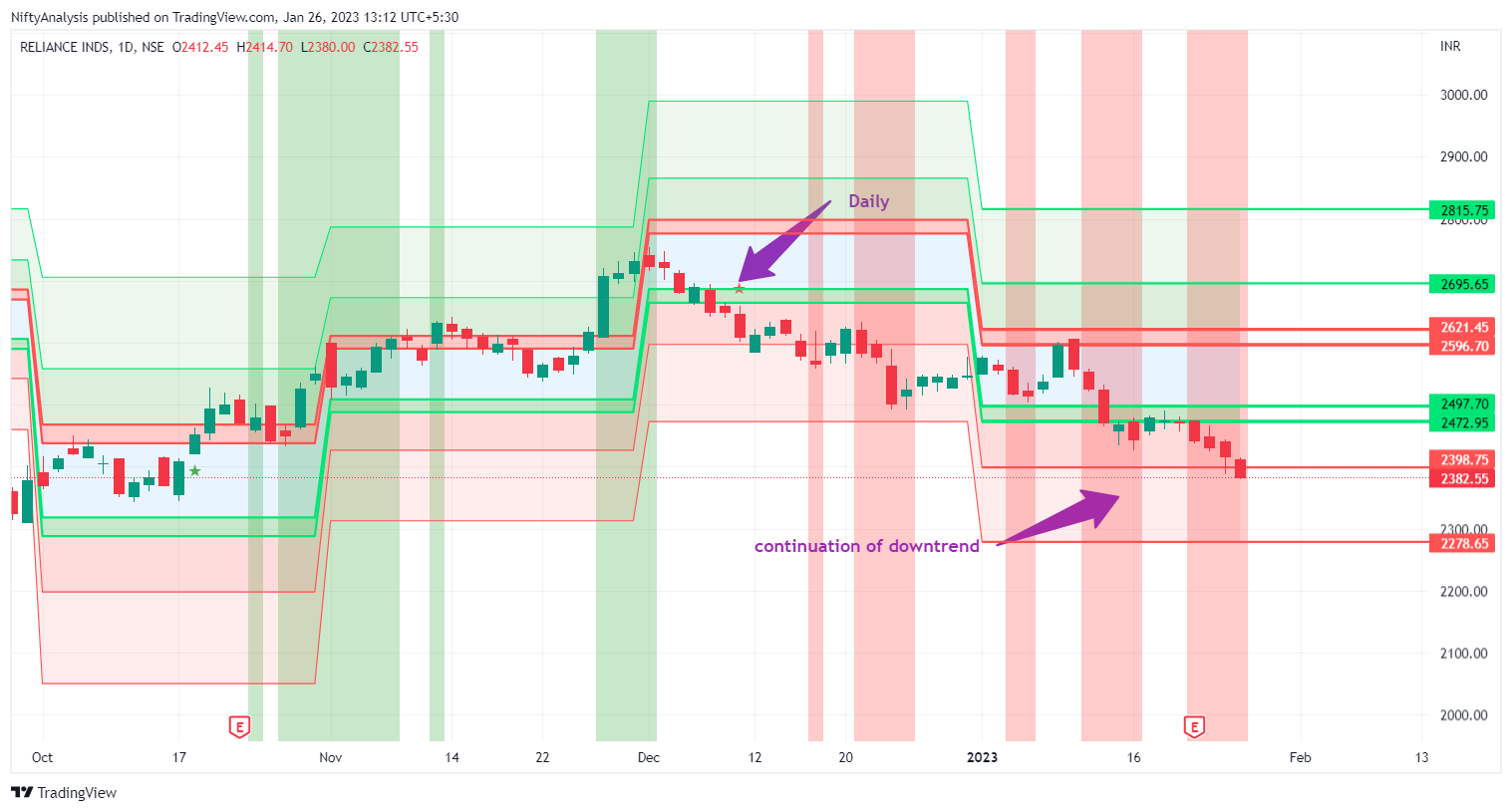

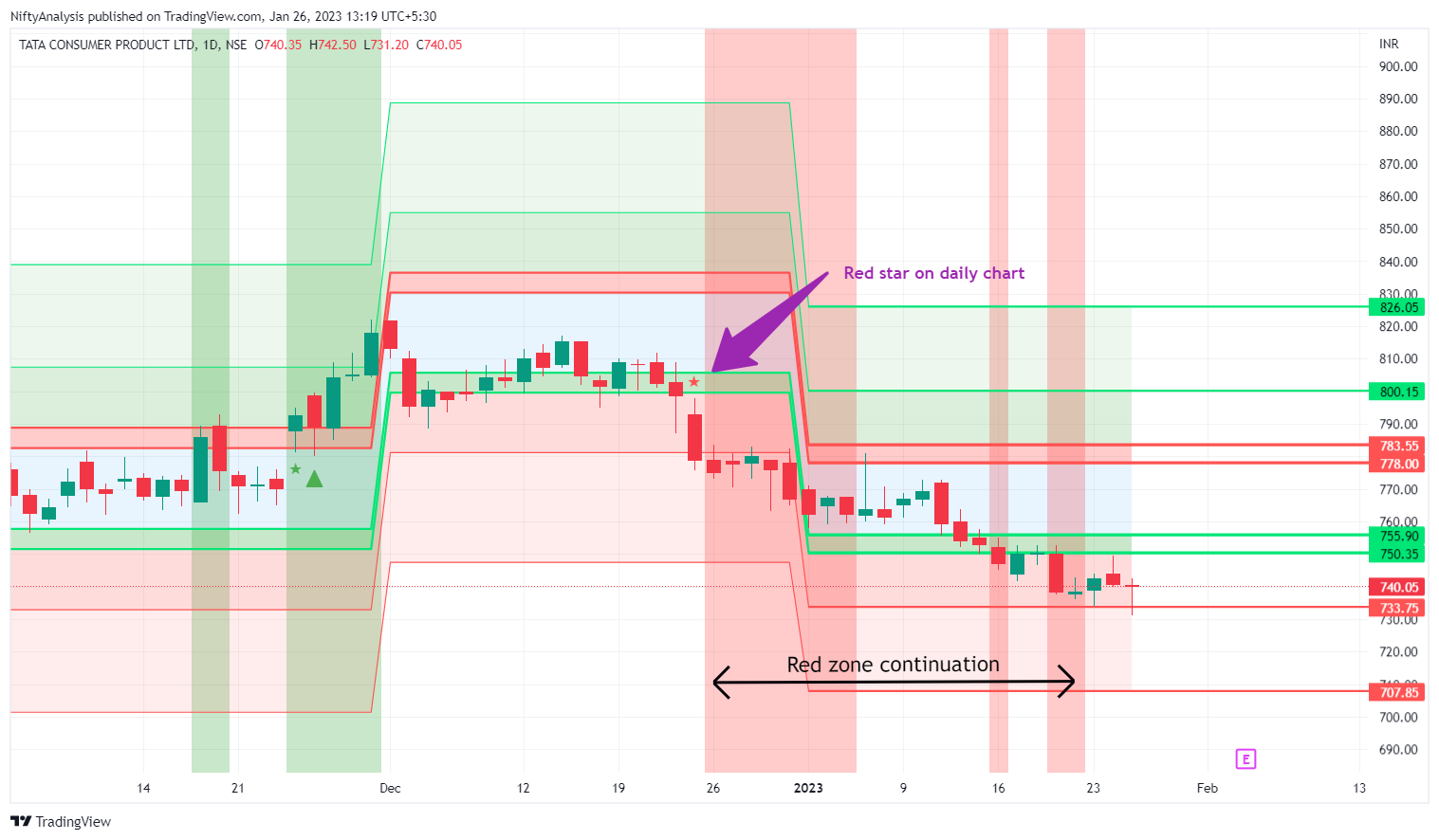

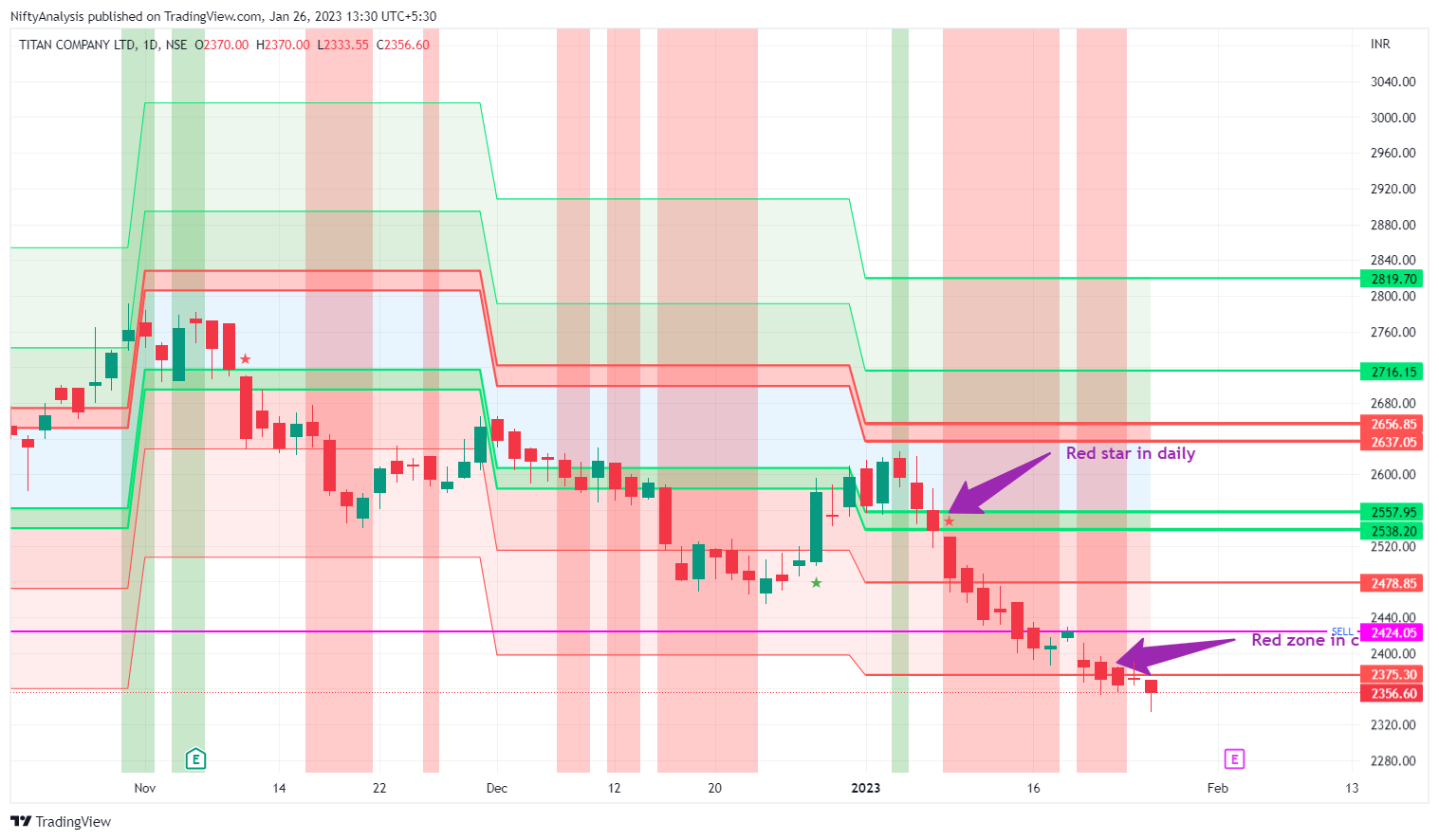

Check the latest star (uptrend or downtrend shown as green star and red star respectively on the chart) on a daily timeframe.

Check if the sentiment zone is also in support or not. For eg., for a red star, there must be a red zone and for a green star, a green zone. To know more about zones, check our home-page FAQ segment (just scroll down a bit and there you will find it.)

Check the current zone and whether the price is at the Green band or the Red band. A green band is related to buying entries. A red band is for selling entries.

Take entires on a 3-min (also can be traded in a 5-min timeframe) timeframe. For a sell take entry at the red band. If there is a red star just before we plan to enter and a red zone, then it increases the accuracy level to 90+%. For a buy entry, the price shall be at the green band, and the same is the accuracy if there is a green star and zone in agreement with our entry decision.

Let’s have a look at how few stocks were picked, what was that easy rule, and how it responds to the market situation because Mind it! we are here to go with the flow along with the big fish in the market.

Adani Ports:

Adani Ports with Bhoomi Indicator.

2. Bajaj Finance

Bajajfinance with Bhoomi Indicator

3. Divis Labs

Divis Labs with Bhoomi Indicator

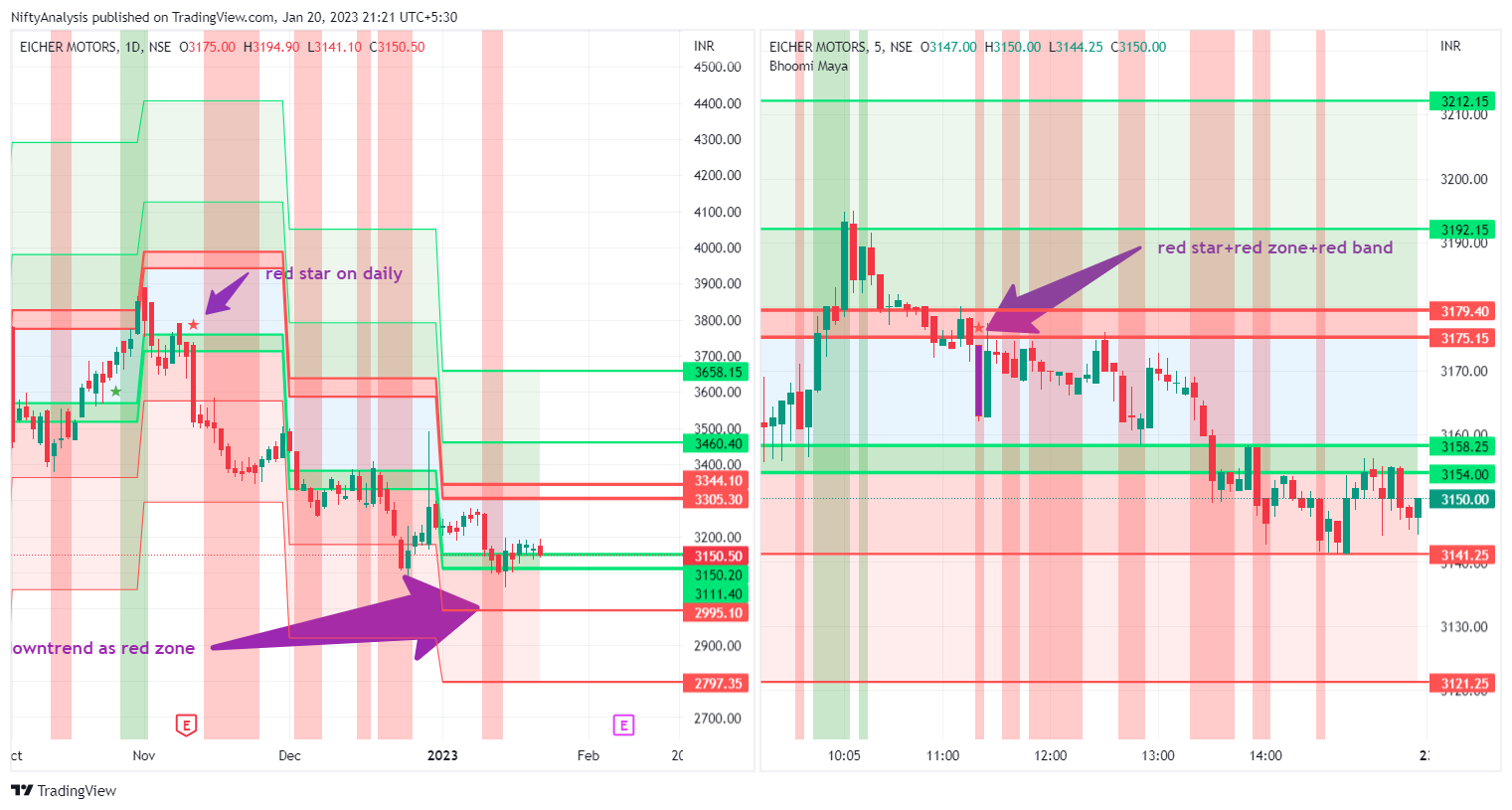

4. Eicher Motors

Eicher Motors with Bhoomi Indicator

6. Titan

Titan with Bhoomi Indicator

7. Bajaj_Auto

Bajaj_Auto with Bhoomi Indicator

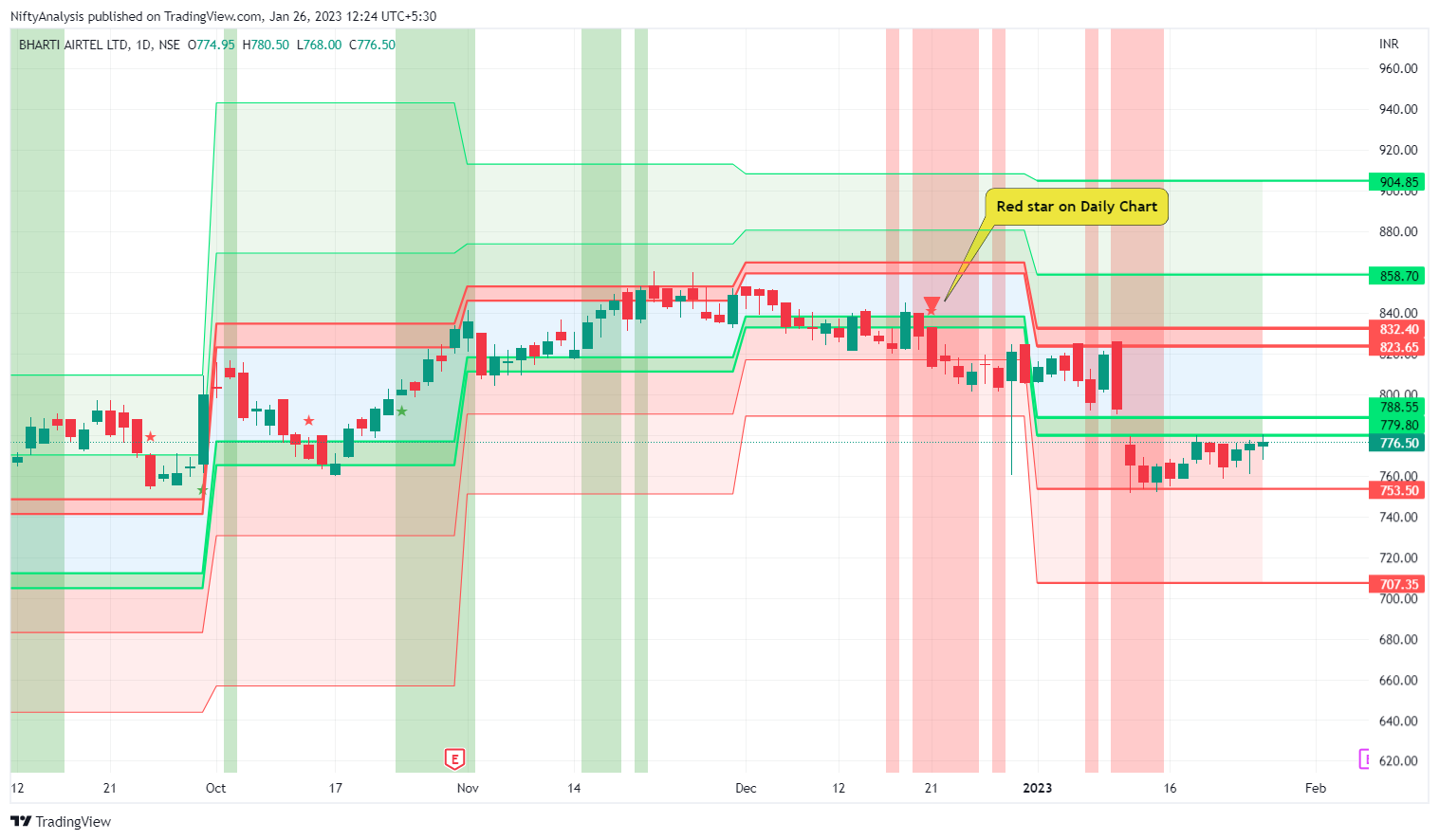

8. Bharti Airtel

Airtel with Bhoomi Indicator

9. ICICI Bank

ICICI Bank with Bhoomi Indicator

10. Kotak Bank

Kotak Bank with Bhoomi Indicator

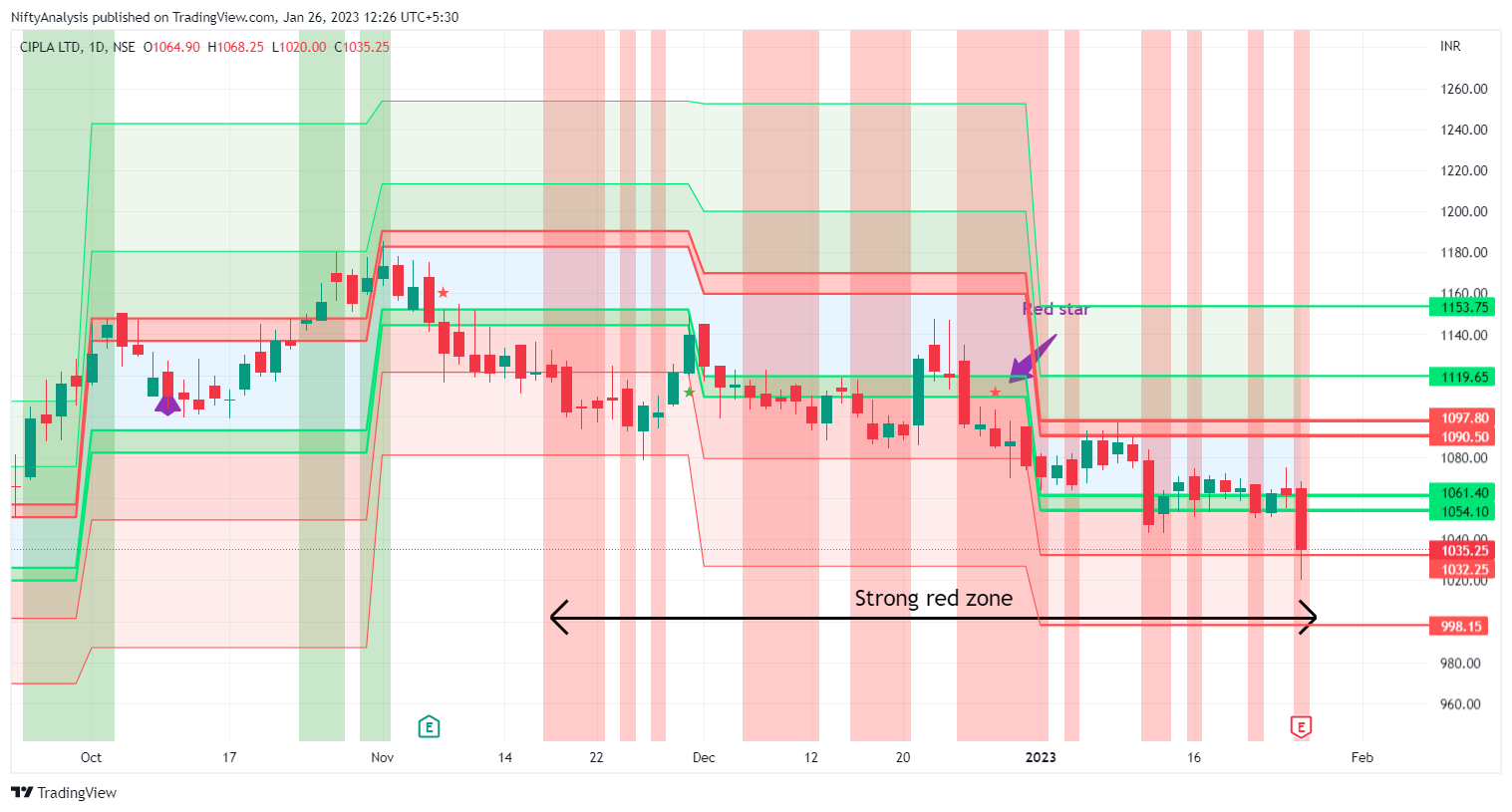

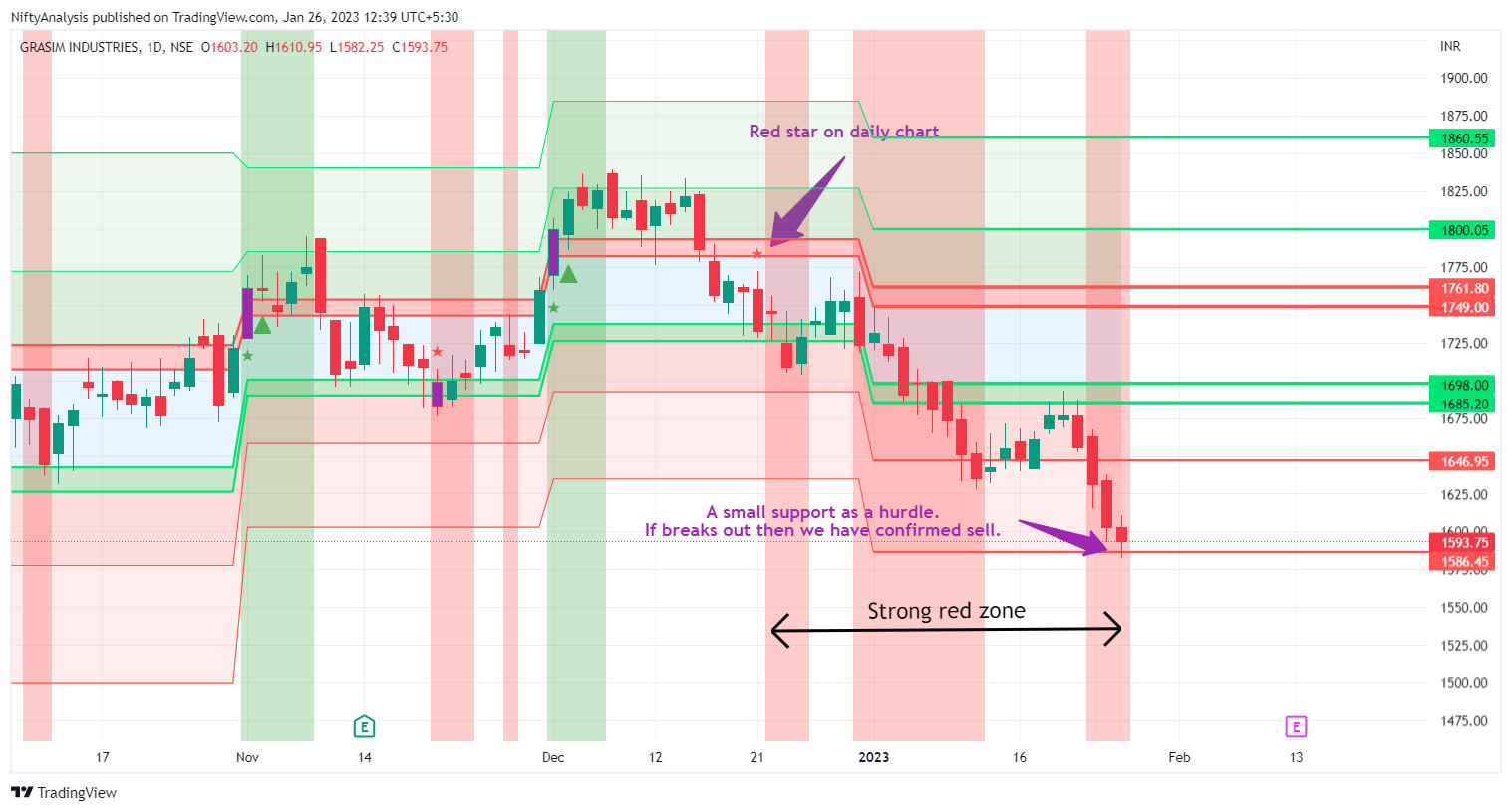

Stocks in Focus:

Based on these simple rules, there are a few stocks that we have picked for the upcoming session on Friday 27th Jan 2023. These are:

Have a quick look at the charts and do a thorough study as to which side we are looking for these stocks to go :) Don’t forget to share your view/answers in the comment section or on our twitter mentions.

HAPPY TRADING.